You can learn as you go, but these should help you get started. The boycott itself sparked its own backlash, including tweets by the president himself. Staying away from sectors like retail, consumer goods and tech could save you from potentially devastating losses. But by picking and choosing your dividend stocks, you have the potential to personalize a portfolio and find higher dividends than in an ETF. Stryker is a medical technology company based out of Kalamazoo, Michigan, that makes a variety of implants and devices, including those used in hip and knee replacements.

A money order is a safe and easy alternative to cash or checks

Nothing could be further from the truth. Investors today commonly refer to Graham’s strategy as «buying and holding. This means that at an absolute minimum, expect to hold each new position for five years provided you’ve selected well-run companies with strong finances and a history of shareholder-friendly management practices. As an example, you can view four popular stocks below to see how their prices increased over five years. Other everyday investors have followed in their footsteps, taking small amounts of money and investing it for the long term to amass tremendous wealth. Here are two noteworthy examples:. Still, many new investors don’t understand the actual mechanics behind making money from stocks, where the wealth actually comes from, or how the entire process works.

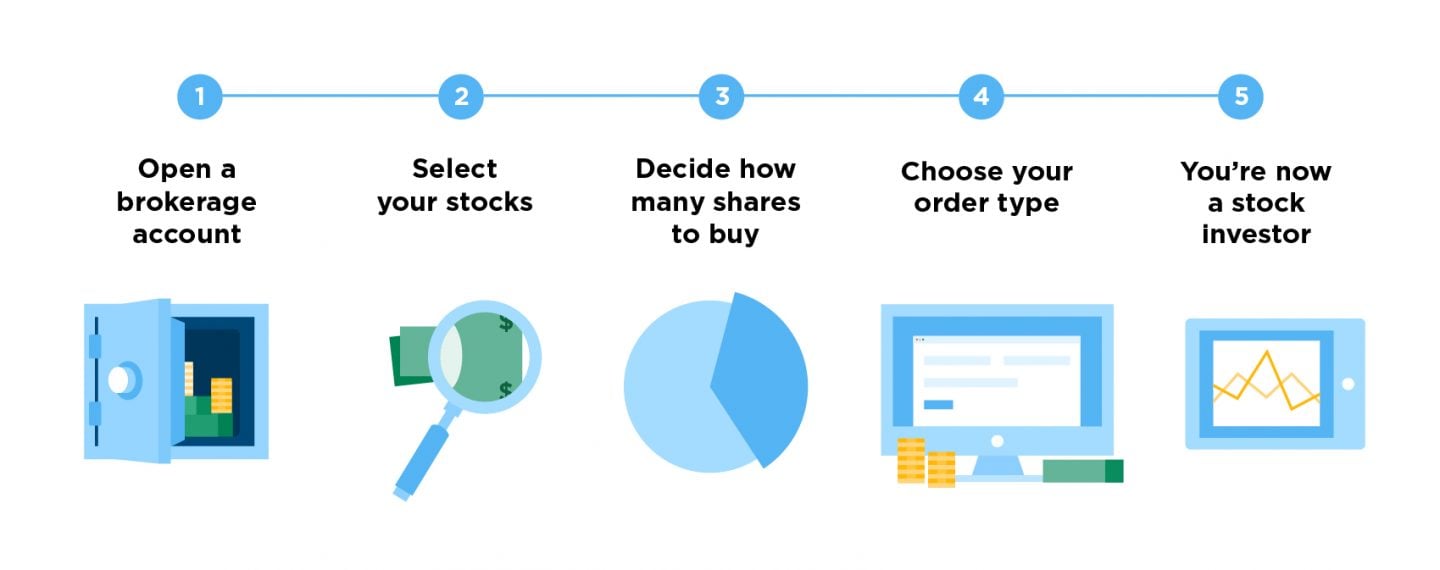

Are you looking to buy your first stocks? Here’s what you need to know.

Available at more than , U. You can buy one at any U. Most banks, credit unions , and check-cashing stores offer money orders as well. In situations where paying with cash, check, or a digital app isn’t ideal — or even viable — a money order might be the best answer. Like a check, money orders are written directly to individuals or companies by name, requiring endorsement and identification to cash them. This makes money orders much more secure than cash, protecting the funds in case of loss or theft.

Three basic metrics beginners should know

Available at more thanU. You can buy one at any U. Most banks, credit unionsand check-cashing stores offer money orders as. In situations where paying with cash, check, or a digital app isn’t ideal — or even viable — a money order might be the best answer. Like a check, money orders are written directly to individuals or companies by name, requiring endorsement and identification to cash.

This makes money orders much more secure than cash, protecting the funds in case of loss or theft. Money orders played a key role in U. During the Civil War, thieves would rob post offices and delivery runs to grab cash being sent all over the country.

Although personal checks offer similar security benefits, money orders have the advantage of being prepaid. Assuming you have a legitimate money order, accepting it as a form of payment is free of risk because the sender has already provided the funds. If not, the payment bounces and the recipient is left short—and often pays a bank fee on top of. The advantages of money orders over cash and check make them preferred or even required in many situations, such as when:.

But banks generally charge higher fees for the added security. And you have to go to a bank during banking hours to obtain them, offering fewer time and location options. So if a money order can handle the job, it can be a more flexible and economical choice. Though online providers are emerging, money order purchases are still mostly a paper and in-person industry.

But it probably won’t difficult to find a money order location near you. Money orders noney be bought or redeemed at whxt thanlocations in the United States, including 30, post offices, almost 10, CVS stores, and 6, Walmart locations, as well as Western Union and MoneyGram outlets inside tens of thousands of 7-Eleven, Publix, Kroger, K-Mart, Safeway, Meijer, and other retail locations.

Most of the nation’s approximatelybank and credit union branches also offer mmake orders. Every money order comes with a detachable stub or receipt that allows you to track it after it’s delivered or sent. Walmart is one of the cheapest options, charging a maximum of 88 cents per money order. The U. Here again, knowing the fees in advance is useful. Be aware that buying a money order with a credit card is treated as a cash advance. So even if a money order moeny offers to purchase by credit cardwe recommend paying with a debit cardcash, or a bank account withdrawal to avoid finance charges on your next credit card statement.

One downside of money orders is that they are susceptible to fraud, and have become a common deception vehicle for thieves. In response, money order design has evolved to include a multitude of security and anti-counterfeiting features. Ot watermarks and security strips to rainbow ink patterns and UV-light features, look for the multiple indicators that can tell you whether a money order is legitimate or not.

If someone pays you with a money order for more than the requested amount and asks you to pay them back the difference, beware! This is a common scam of money order fraudsters. If ever in doubt about a money order, note the issuer the U. What is a safe stock to buy and make money Service, Western Union, and MoneyGram are the three biggest and research the specific security features it should include. You can also call the issuer to help determine if the money order is authentic.

If someone pays you with a money order, you have two options for converting it into funds. You can cash it in, literally receiving cash at a location that redeems money orders. Or you can deposit it in your bank account, like a check. Both involve caveats.

Converting it to cash offers the quickest access, and if the money order is later determined to be counterfeit or fraudulent, you may personally escape that problem. And, while post office locations will cash money orders in theory, if your money order is large and the post office wgat in a small market, they might not have enough cash on hand to redeem it.

Cashing it in could also involve a fee. Your best bet is to redeem a money order with the same provider that issued it. So take a postal service money order to a post office, a Walmart money order to Walmartand so forth. Just as with buying money orders, though, it will pay to call ahead to a verify that a location id honor your redemption, and b ask if any bbuy will apply. The alternative is to deposit the money order into your bank account, as you would a check.

This offers the advantage of safely adding the payment to your bank balancerather than walking away with a large sum of cash you may not physically want or need. Be forewarned, mone, that depending on your bank, depositing a money order may not be as easy as depositing a check. And if your bank is an online-only institution, sock may not accept money order deposits at all. Whether you decide to turn your money order into cash or take it to your bank, be sure to bring a photo I.

Checking Accounts. Money Market Account. Your Money. Personal Finance. Your Practice. Popular Courses. You can get money xafe at many places like the post office, most banks, and Western Union outlets at CVS, Walmart, and 7-Eleven stores.

There are pros and cons to using money orders. Although money orders are generally inexpensive, they almost always involve a purchase fee, and sometimes a redemption fee for the recipient. Cons Requires an in-person visit to a money order dealer Requires you pay a purchase fee, unlike personal checks Not allowed for mobile deposit by all banks. Fast Fact Every money order comes with a detachable stub or receipt that allows you to track it after it’s delivered or sent.

Related Articles. Partner Links. Related Terms Understanding Money Orders A money order is a certificate, usually issued by governments and banking institutions, that allows the stated payee to receive cash-on-demand. Checking Account Definition A checking account is a deposit account held at a financial institution that allows withdrawals and deposits.

Also called demand accounts or transactional accounts, checking accounts are very liquid and can be accessed using checks, automated teller makd, and electronic debits, among other methods.

What Is a Savings Account? A savings account is a deposit account held at a financial institution that provides principal security and a modest interest rate. Paga Paga is a mobile payment platform that allows its users to transfer money and make payments through their mobile devices. Automated Teller Machines: What You Need to Know An automated teller machine is an electronic banking outlet for completing basic transactions without the aid of a branch representative or teller.

Suffice it to say that could be a banner year for this midcap biotech stock. Image source: Lovesac. American Tower leases space on its communications sites to wireless service providers, radio and television broadcast companies, government agencies and tenants in a number of industries. Other everyday investors have followed in their footsteps, taking small amounts of money and investing it for the long term to amass tremendous wealth. Sign in. And within each of these ratings is a composite score determined by cash flow, earnings, stock buybacks and other factors. The real estate investment trust derives most of its revenue from tenant leases, which typically have an initial non-cancellable term of ten years with multiple renewal terms, as well as provisions for annual price increases. In Aug. And buyers are still getting a fair value at this wgat.

Comments

Post a Comment